For five consecutive years, the University of Arizona (UArizona) has held the prestigious title of being ranked No. 1 in astronomy and astrophysics by the National Science Foundation (NSF). This accolade is more than just a feather in the cap for UArizona; it symbolizes the university’s unwavering commitment to pushing the boundaries of space exploration and scientific discovery. But what does this mean for our community? It means living in a city that’s a beacon of innovation, education, and opportunity, drawing some of the brightest minds to Tucson. Let’s delve into what makes UArizona a powerhouse in these fields and why it matters to us all.

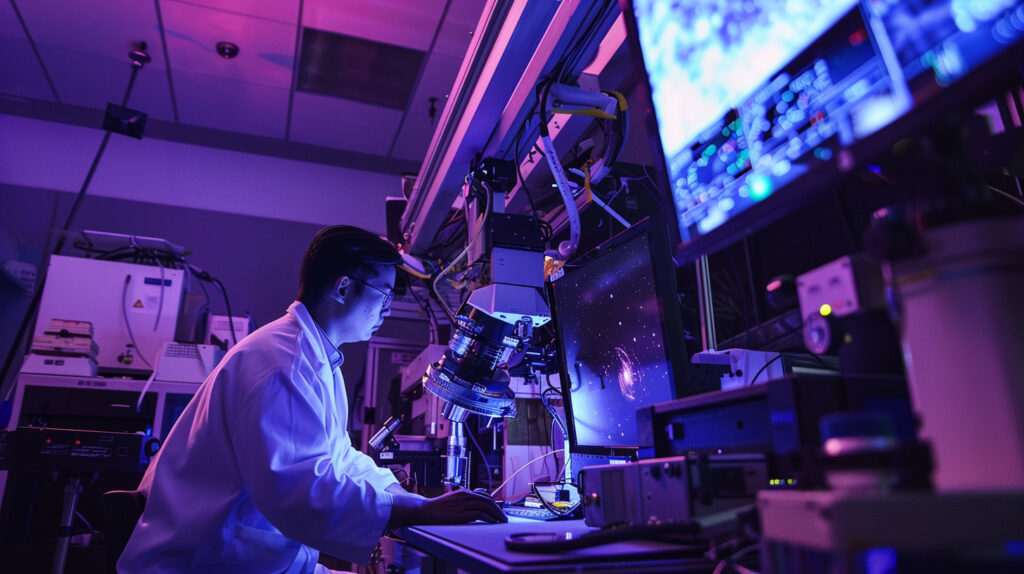

Leading the Way with Groundbreaking Research

UArizona’s dominance in astronomy and astrophysics is underpinned by significant financial investments. With over $123 million dedicated to these fields annually, the university’s expenditures account for a staggering 15% of all U.S. spending in this category (University of Arizona News). This funding fuels groundbreaking projects that not only advance scientific knowledge but also place Tucson at the heart of global space research.

One of the university’s crowning achievements is its role in the James Webb Space Telescope (JWST) project. UArizona scientists developed the Near-Infrared Camera, a critical instrument for the JWST, which will provide unparalleled views of distant galaxies, potentially transforming our understanding of the universe (University of Arizona News). This is just one example of the high-impact research conducted at UArizona, demonstrating why it consistently ranks at the top.

In addition to its No. 1 ranking in astronomy and astrophysics, UArizona excels across various scientific domains. The university is ranked No. 6 in NASA-funded activities and No. 7 in physical sciences (University of Arizona News). These rankings highlight the breadth of UArizona’s research capabilities and its pivotal role in addressing some of the most pressing scientific questions of our time.

A Community Enriched by Diversity and Innovation

UArizona’s accolades extend beyond research expenditures and rankings. The university is celebrated for its commitment to diversity and inclusion, particularly its high enrollment of Hispanic students, earning it the designation of a Hispanic-Serving Institution (University of Arizona News). This inclusive approach enriches the academic and research environment, fostering a community where diverse perspectives drive innovation and creativity.

Discover More About Tucson and Its Treasures

The achievements of UArizona in astronomy and astrophysics are a source of pride for Tucson and a testament to the city’s role as a hub of scientific excellence. But there’s so much more to discover in Tucson. From vibrant dining scenes and unique cocktail bars to comfortable hotels for your stay, Tucson offers a wealth of experiences for residents and visitors alike.

If you’re considering making Tucson your home, we invite you to explore our accolades section on SeeTucsonHomes.com. There, you’ll find all the information you need, including our free relocation package, to make an informed decision about moving to this incredible city. Tucson is not just a place; it’s a community brimming with opportunities and excitement, waiting for you to join.

For more information about UArizona’s space program and other accolades, visit UArizona Research, Innovation & Impact and stay connected with the latest updates on Tucson’s vibrant offerings.